You may consider hiring a buyer's representative if you plan to sell your home without the help of a realtor. The buyer's agent coordinates all documents signing and ensures that all terms of the purchase agreement are met. The title is then transferred and the deed recorded.

A house can be sold by the owner without the involvement of a realtor

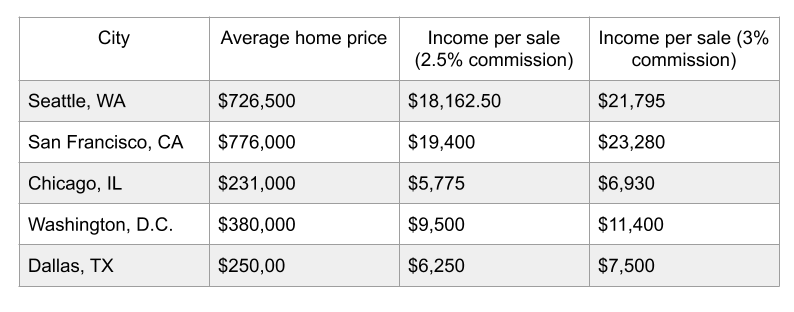

Selling your home by yourself without the assistance of a realtor can save you money. A full commission could cost you between five percent and seven per cent of the sale price. Reduce or eliminate commissions to save money and make your home sell faster. However, the process comes with its own challenges. You will need to devote a great deal of your time to the sale. Additionally, you will need to spend time showing your home and meeting potential buyers. It is possible to make this difficult if your schedule includes work.

Agents often charge significant commissions. Your agent would get $10,500 if you sold your house for $350,000. This money will cover the costs of an agent. Additionally, you will have extra cash in your bank account if you sell your house on your own.

Agent for buyers

The buyer's agent should be paid a commission, but they shouldn't be the only person involved in the transaction. You should have an agent representing you as a seller. An agent will help you to navigate through paperwork and make sure everything runs smoothly. An agent will help you negotiate the best price for your house.

A buyer's agency is also a great option because of their experience in selling houses. They can guide you through a property to highlight potential issues and make suggestions for improvements that will help buyers. An agent can also highlight important inspection issues and ensure that all legal boxes are checked.

Pricing your home

You may wonder how to price your home if you are selling your home without the help of a realtor. A real estate agent can help you determine a listing price for your house. This will ensure you get the highest possible price for your property. It is important to price your home correctly. However, there are some things you should consider.

First, do a market analysis before setting the price. To determine the house's value, you need to run a comparative marketplace analysis of similar sales in your region. Don't let emotion influence your pricing decision. It doesn't matter if you love the house. Look at similar properties that have been sold in your area and compare them. You can also use a standardized HPI calculator provided by the Federal Housing Finance Agency, but don't take its value as gospel.

Accepting offers

A buyer who accepts an offer to buy a house without a realtor is allowed to accept the deal without paying a commission, but it's important to remember that the buyer is still expected to pay the agent's commission. In some states, the buyer’s agent could also be the seller’s. This is known as dual agency, and the agent will not be able to fully represent both the buyer and seller.

If you decide to accept an offer, make sure to read the terms and conditions. The terms of the offer may include conditions that the seller may want to avoid. If the buyer isn't a U.S. citizen, discriminating based on race is prohibited. You cannot refuse to sell your home to someone due to their religion.

FAQ

What is the maximum number of times I can refinance my mortgage?

This will depend on whether you are refinancing through another lender or a mortgage broker. You can refinance in either of these cases once every five-year.

What amount of money can I get for my house?

This varies greatly based on several factors, such as the condition of your home and the amount of time it has been on the market. Zillow.com says that the average selling cost for a US house is $203,000 This

What should I be looking for in a mortgage agent?

People who aren't eligible for traditional mortgages can be helped by a mortgage broker. They search through lenders to find the right deal for their clients. There are some brokers that charge a fee to provide this service. Others offer no cost services.

What is a reverse loan?

A reverse mortgage allows you to borrow money from your house without having to sell any of the equity. It works by allowing you to draw down funds from your home equity while still living there. There are two types: government-insured and conventional. You must repay the amount borrowed and pay an origination fee for a conventional reverse loan. FHA insurance covers your repayments.

How much does it take to replace windows?

The cost of replacing windows is between $1,500 and $3,000 per window. The exact size, style, brand, and cost of all windows replacement will vary depending on what you choose.

Statistics

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

External Links

How To

How to find houses to rent

Finding houses to rent is one of the most common tasks for people who want to move into new places. It can be difficult to find the right home. Many factors affect your decision-making process when choosing a home. These factors include price, location, size, number, amenities, and so forth.

It is important to start searching for properties early in order to get the best deal. Also, ask your friends, family, landlords, real-estate agents, and property mangers for recommendations. You'll be able to select from many options.