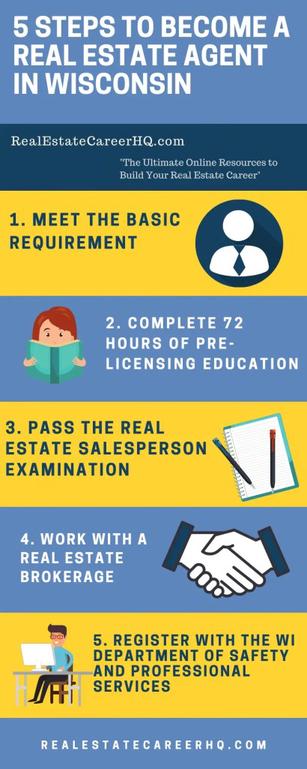

Before you can work as a real estate agent, you will need to have a California licensed real estate license. There are a few steps you need to take, such as sending a fingerprint form to the Bureau of Real Estate in Sacramento. Next, you'll need to go to school that offers real property training.

California Real Estate License Courses

You must first complete the pre-license classes to get a California realty license. These courses should be taken at a college or university that is accredited. The Department of Real Estate keeps a list of accredited institutions. Alternatively, you can take classes online. You should however be aware of the financial and time requirements.

The courses you take must be approved by the state's Department of Real Estate. AceableAgent is an accredited online school for real estate in California. The courses are updated regularly and are often available at discount rates. The course materials can be difficult to read, and students often report taking too much time to understand the information.

Exam pass rate

There are many methods to study for your real estate license exam. Your success depends on choosing the right program. Make sure you enroll in the most comprehensive program available. You should also be able to take practice tests and quizzes as well as prepare for the written exam. You may also find audio and video courses in some programs.

Some real estate schools have high pass rates. CE Shop boasts a 91% success rate. Their courses are always up to date with the latest information. You may also find discounted courses. You should also be aware that course materials can be hard to follow. Many students find the course materials difficult to comprehend.

Pre-licensing requirements

A pre-licensing class is the first step to obtaining a California real estate license. You can choose from a variety of online courses that will prepare for the real estate exam. An excellent prep course will offer additional study resources as well as real-world scenarios.

California requires you to complete at least one pre-licensing class and 135 hours in related coursework. The California Department of Real Estate website will tell you how many hours of training is required.

School requirements

California law requires that real estate license holders complete at least one academic year. The course must have at least two core classes that total 135 hour. Real Estate Principles covers real estate ethics and law. The second course covers financing, contracts, and escrow procedures. A listing course must be completed by students.

Students must not only take the core courses but also undergo a background check that includes a live scan and analysis of criminal records. Failure to disclose a criminal past may result in denial of a license. The state exam is difficult. However, many schools offer extra resources for students in preparation for the exam.

FAQ

How do I repair my roof

Roofs can become leaky due to wear and tear, weather conditions, or improper maintenance. Roofing contractors can help with minor repairs and replacements. Contact us to find out more.

How many times can my mortgage be refinanced?

This will depend on whether you are refinancing through another lender or a mortgage broker. You can refinance in either of these cases once every five-year.

What are the downsides to a fixed-rate loan?

Fixed-rate loans tend to carry higher initial costs than adjustable-rate mortgages. You may also lose a lot if your house is sold before the term ends.

Is it better to buy or rent?

Renting is usually cheaper than buying a house. But, it's important to understand that you'll have to pay for additional expenses like utilities, repairs, and maintenance. The benefits of buying a house are not only obvious but also numerous. For instance, you will have more control over your living situation.

Can I purchase a house with no down payment?

Yes! There are many programs that can help people who don’t have a lot of money to purchase a property. These programs include FHA loans, VA loans. USDA loans and conventional mortgages. You can find more information on our website.

Can I get a second mortgage?

However, it is advisable to seek professional advice before deciding whether to get one. A second mortgage is usually used to consolidate existing debts and to finance home improvements.

Statistics

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

How to Manage A Rental Property

It can be a great way for you to make extra income, but there are many things to consider before you rent your house. We'll help you understand what to look for when renting out your home.

Here's how to rent your home.

-

What should I consider first? Take a look at your financial situation before you decide whether you want to rent your house. You may not be financially able to rent out your house to someone else if you have credit card debts or mortgage payments. You should also check your budget - if you don't have enough money to cover your monthly expenses (rent, utilities, insurance, etc. This might be a waste of money.

-

How much will it cost to rent my house? It is possible to charge a higher price for renting your house if you consider many factors. These factors include your location, the size of your home, its condition, and the season. It's important to remember that prices vary depending on where you live, so don't expect to get the same rate everywhere. Rightmove shows that the median market price for renting one-bedroom flats in London is approximately PS1,400 per months. This would translate into a total of PS2,800 per calendar year if you rented your entire home. That's not bad, but if you only wanted to let part of your home, you could probably earn significantly less.

-

Is it worthwhile? It's always risky to try something new. But if it gives you extra income, why not? Be sure to fully understand what you are signing before you sign anything. It's not enough to be able to spend more time with your loved ones. You'll need to manage maintenance costs, repair and clean up the house. Before signing up, be sure to carefully consider these factors.

-

Are there benefits? So now that you know how much it costs to rent out your home and you're confident that it's worth it, you'll need to think about the advantages. There are many reasons to rent your home. You can use it to pay off debt, buy a holiday, save for a rainy-day, or simply to have a break. No matter what your choice, renting is likely to be more rewarding than working every single day. If you plan ahead, rent could be your full-time job.

-

How do I find tenants After you have decided to rent your property, you will need to properly advertise it. Listing your property online through websites like Rightmove or Zoopla is a good place to start. After potential tenants have contacted you, arrange an interview. This will allow you to assess their suitability, and make sure they are financially sound enough to move into your house.

-

How do I ensure I am covered? If you're worried about leaving your home empty, you'll need to ensure you're fully protected against damage, theft, or fire. You'll need to insure your home, which you can do either through your landlord or directly with an insurer. Your landlord will typically require you to add them in as additional insured. This covers damages to your property that occur while you aren't there. If you are not registered with UK insurers or if your landlord lives abroad, however, this does not apply. In such cases you will need a registration with an international insurance.

-

Sometimes it can feel as though you don’t have the money to spend all day looking at tenants, especially if there are no other jobs. However, it is important that you advertise your property in the best way possible. Post ads online and create a professional-looking site. It is also necessary to create a complete application form and give references. Some people prefer to do everything themselves while others hire agents who will take care of all the details. You'll need to be ready to answer questions during interviews.

-

What should I do after I have found my tenant? If there is a lease, you will need to inform the tenant about any changes such as moving dates. If you don't have a lease, you can negotiate length of stay, deposit, or other details. Keep in mind that you will still be responsible for paying utilities and other costs once your tenancy ends.

-

How do I collect the rent? When the time comes for you to collect the rent you need to make sure that your tenant has been paying their rent. If not, you'll need to remind them of their obligations. You can subtract any outstanding rent payments before sending them a final check. If you're struggling to get hold of your tenant, you can always call the police. They will not usually evict someone unless they have a breached the contract. But, they can issue a warrant if necessary.

-

How can I avoid problems? Renting out your house can make you a lot of money, but it's also important to stay safe. Make sure you have carbon monoxide detectors installed and security cameras installed. You should also check that your neighbors' permissions allow you to leave your property unlocked at night and that you have adequate insurance. You should not allow strangers to enter your home, even if they claim they are moving in next door.